Employees with multiple roles in the same company may have different hourly rates for each job. For instance, an employee could earn $15 per hour as a receptionist, $20 per hour as a customer service representative, and $25 per hour as a project coordinator. When this employee works overtime, calculating their overtime pay can be complicated because of the different pay rates. To find the correct overtime rate, you should first calculate the weighted average of their various hourly rates. This method, known as weighted or blended overtime, involves averaging the employee's different pay rates and then using this average to calculate their overtime wages. This is different from the traditional method of paying 1.5 times the employee’s regular pay rate for all hours worked beyond 40 hours in a week or 8 hours in a day.

WorkEasy Software calculates the weighted average overtime automatically using three different formulas:

Weighted Base Rate

Reg Rate + Weighted Factor

Weighted Base Rate x Factor

Weighted Base Rate

This method calculates the overtime rate by averaging the employee's regular pay rates and multiplying that average by the overtime factor. This means all overtime hours will be paid at the same rate, regardless of the shift the employee worked.

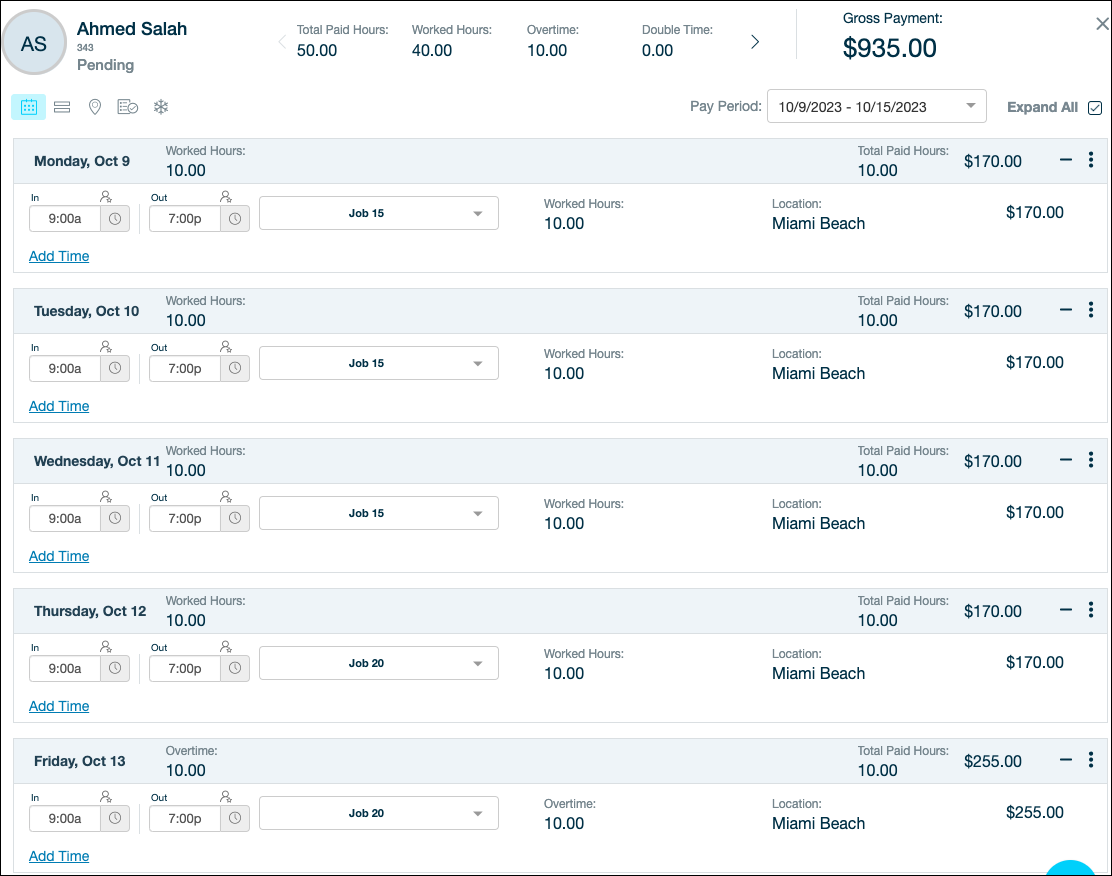

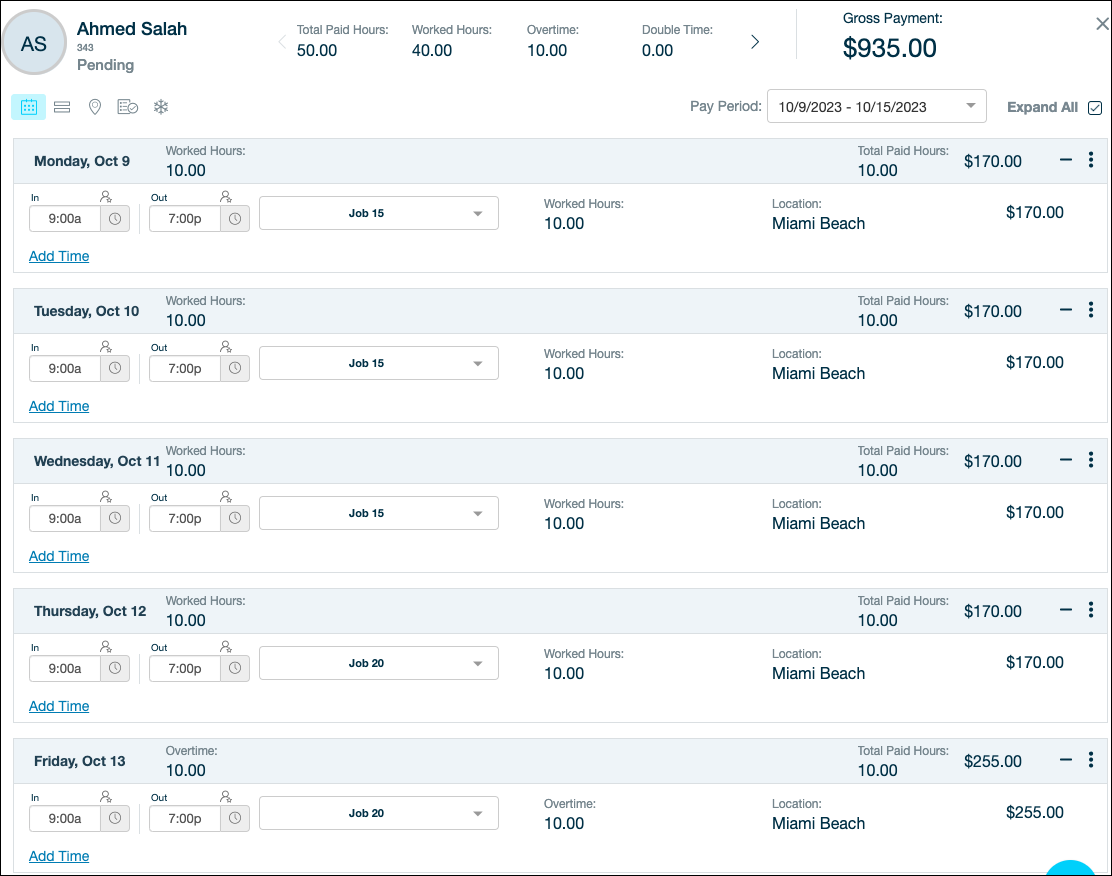

Here's an example.

An employee worked 50 hours in one week in two different jobs:

In Job 1, he worked 30 hours at $15 per hour.

in Job 2, he worked 20 hours at $20 per hour.

The factor is 1.5.

The weighted base rate would be calculated as follows:

Weighted Base Rate = All Wages / All Hours - (h1 x r1 + h2 x r2) / (h1 + h2)

= ($15 x 30 + $20 x 20) / 50

= $17

The overtime rate would be calculated as follows:

Overtime Rate = Weighted Base Rate x Factor

= $17 x 1.5

= $25.5

Therefore, the final payment for this employee would be:

Final Payment = Regular Pay + Overtime Pay

= (40 x $17) + (10 x $25.5)

= $680 + $255

= $935

Reg Rate + Weighted Factor

This method keeps the employee's regular pay rate the same but calculates the overtime rate by adding the weighted factor to the regular rate. The weighted factor is found by multiplying the weighted base rate by (factor - 1).

Here's an example.

An employee worked 50 hours in one week in two different jobs:

In Job 1, he worked 30 hours at $15 per hour.

in Job 2, he worked 20 hours at $20 per hour.

The factor is 1.5.

The weighted base rate would be calculated as follows:

Weighted Base Rate = All Wages / All Hours - (h1 x r1 + h2 x r2) / (h1 + h2)

= ($15 x 30 + $20 x 20) / 50

= $17

The overtime rate would be calculated as follows:

Weighted Factor = Weighted Base Rate x (Factor - 1)

= $17 x (1.5 - 1)

= $8.5

Overtime Rate for Job 1 = RegRate + Weighted Factor

= $15 + $8.5

= $23.5

Overtime Rate for Job 2 = RegRate + Weighted Factor

= $20 + $8.5

= $28.5

Therefore, the final payment for this employee would be:

Final Payment = Regular Pay + Overtime Pay

= (30 x $15) + (10 x $20) + (10 x $28.5)

= $450 + $200 + $285

= $935

Weighted Base Rate x Factor

This method keeps the employee's regular pay rate the same but calculates the overtime rate by multiplying the weighted base rate by the overtime factor.

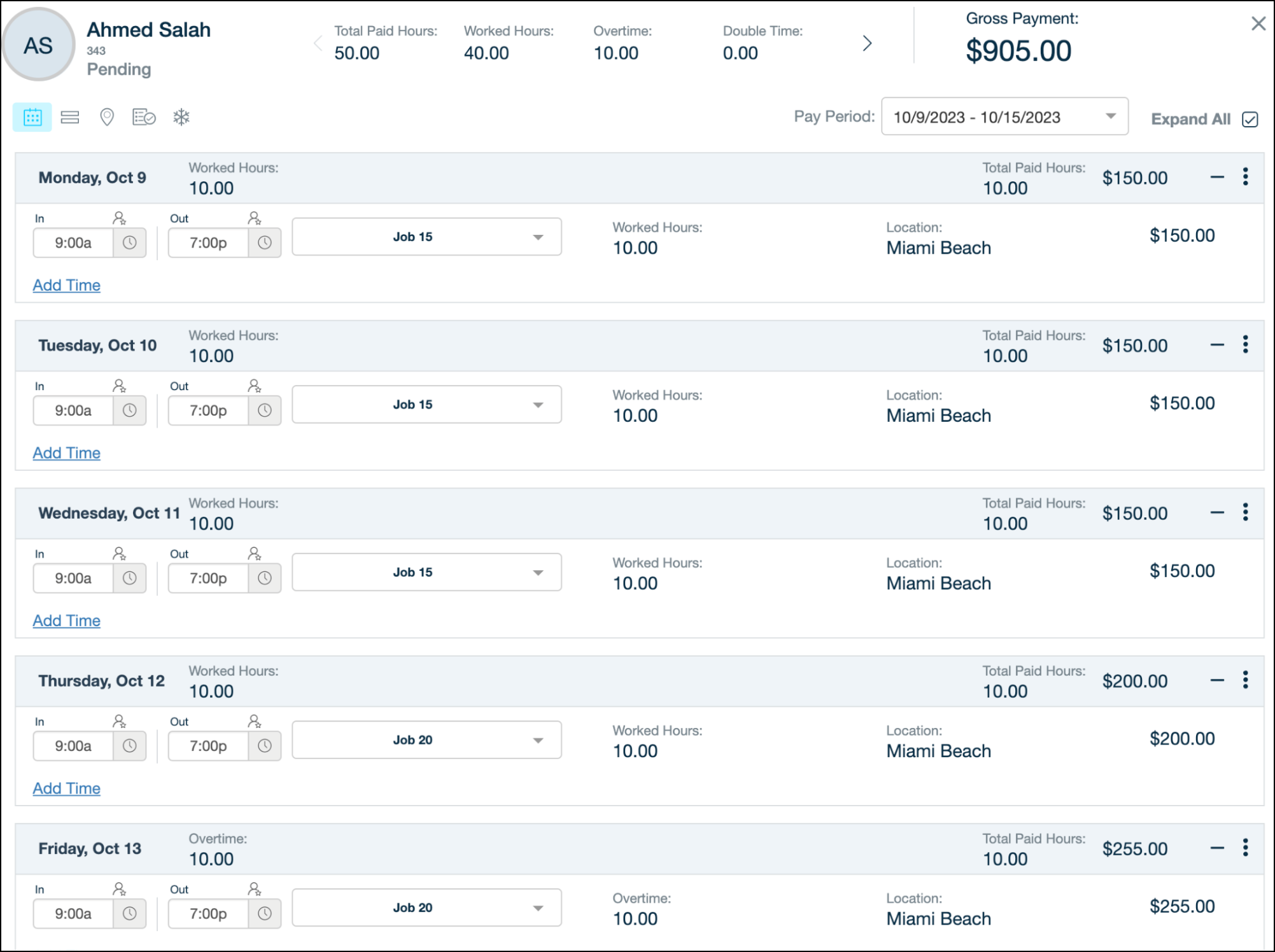

Here's an example.

An employee worked 50 hours in one week in two different jobs:

In Job 1, he worked 30 hours at $15 per hour.

in Job 2, he worked 20 hours at $20 per hour.

The factor is 1.5.

The weighted base rate would be calculated as follows:

Weighted Base Rate = All Wages / All Hours - (h1 x r1 + h2 x r2) / (h1 + h2)

= ($15 x 30 + $20 x 20) / 50

= $17

The overtime rate would be calculated as follows:

Weighted Factor = Weighted Base Rate x (Factor - 1)

= $17 x (1.5 - 1)

= $25.5

Therefore, the final payment for this employee would be:

Final Payment = Regular Pay + Overtime Pay

= (30 x $15) + (10 x $20) + (10 x $25.5)

= $450 + $200 + $255

= $905

That's it! 😊👍

If you have questions, please call us at (888) 783-1493, email support@workeasysoftware.com, or Submit a Ticket

FAQ

Can employees receive different hourly rates for multiple roles within the same company?

Yes, employees can receive different hourly rates for each position they hold within the same company.

What is weighted or blended overtime?

Weighted or blended overtime is a method of calculating overtime pay by averaging an employee's various pay rates.

How does WorkEasy Software calculate weighted average overtime?

WorkEasy Software calculates weighted average overtime using Weighted Base Rate, Reg Rate + Weighted Factor, and Weighted Base Rate x Factor.

What is the Weighted Base Rate method?

The Weighted Base Rate method averages all of the employee's regular pay rates and multiplies that average by the overtime factor.

Is the regular pay rate changed when using the Reg Rate + Weighted Factor method?

The regular pay rate remains unchanged when using the Reg Rate + Weighted Factor method.

How is the overtime rate calculated using the Weighted Base Rate x Factor method?

The overtime rate is calculated by multiplying the weighted base rate by the overtime factor.

What happens if an employee works overtime in multiple jobs?

Calculating overtime pay can be complex due to varying pay rates, and the weighted average method is used to determine the correct overtime rate.